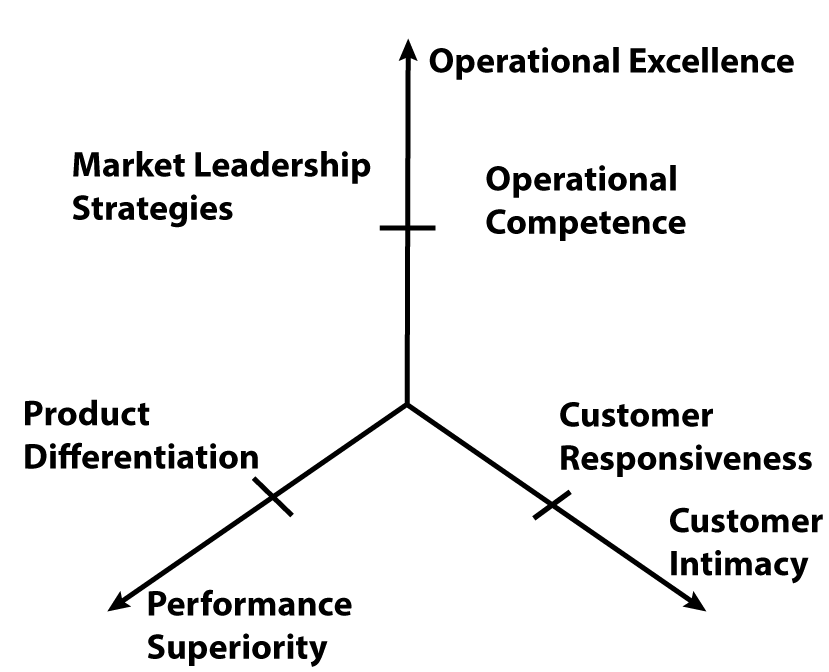

Customer Analytics is all about understanding customer behavior, the consumption patterns that develop over time and the kinds of strategies companies build around those patterns. We start by re-visiting one of the frameworks presented earlier where we laid out the basic types of strategies that companies can follow.

A couple of these strategies are well-defined. Everyone understands that performance superiority calls for having the best product in the market. Whether it's an Apple product, a Budweiser Lite or a luxury product such as a Louis Vuitton or a Gucci, companies want to have the best product. Companies like J D Powers, Consumers Report and trade magazines provide information on product performance as viewed by customers or experts. Customers also vote for their favorite product with their wallet.

Operational excellence is clear and easy to understand as it entails providing the customer with the lowest price, the most effective operation, two-day delivery, or the most efficient experience. For companies like Walmart, IKEA, or Amazon, their focus includes keeping costs low and keeping their processes efficient. Again, that is a distinctive feature of operational excellence companies.

The third strategy, customer intimacy is not as easy to grasp. What exactly does customer intimacy mean? Who is the customer? Are we going to focus on all customers the same way? Just how intimate do we want to get? Finally, how do we make more money on something that actually adds more costs than some of these other strategies? It is imperative that we take this idea of customer intimacy or customer centricity, and clarify what it is, what it isn’t, and its importance. Once that is determined, we'll be able to make well-informed decisions about whether we want to pursue that kind of strategy and if so, how to effectuate it.

The objective of commercial enterprises is to make money. This objective also includes maximizing the value of the whole corporation for the owners. Furthermore, it also involves taking into consideration money made today, as well as money that will be made tomorrow, and money that will be made ten years from now. In terms of the time value of that money, today's dollars are more important than tomorrow's dollars. The overall value of the corporation can be discerned by reviewing the discounted flow of the company's future profits.

Maximizing the value of the corporation requires boosting the net present value of future profits. The question is, how do companies achieve this? Both performance superiority and operational excellence require a blockbuster product or service. It also entails developing a brilliant concept that puts a company steps ahead of the competition and then determining methods to bring that idea, product or service to market. It's conceptualizing, developing, manufacturing, distributing, and marketing that idea, product or service. This is what business is traditionally all about.

In addition to establishing a blockbuster idea, it is essential for most companies to implement a plan that will mass produce their product. Over the years companies have discovered that developing massive quantities of a product or service cannot only generate higher revenue but producing and distributing so much volume brings cost down through economies of scale. In addition, an increased level of production at massive scale can create barriers–to–entry to the market. The core focus of most traditional businesses is creating a successful plan that enables them to produce in high volume and at a low cost. Most new enterprises ask themselves this common question, “Will it scale?” Particularly, can this product or service be produced or delivered at a scale that will generate revenue and keep operating costs down?

A variety of different metrics are available to help companies assess how well they are performing. They can take into consideration the amount of product they are delivering as well as the changes in their costs. Are costs coming down as they develop and deliver more of this product or service? Some metrics that depict how well a business is running are reasonably clear. Other metrics can be confusing, unclear or misleading. A powerful and often used metric is market share. Many companies obsess over market share as it provides a clear indication of how well they are doing relative to their competitors in a given industry. Moreover, it offers distinct projections of future success. Market share also serves as an excellent backward indicator of how companies have performed.

“How likely is it you would recommend us to a friend?” Asking the ultimate question allows companies to track promoters and detractors, producing a clear measure of an organization's performance through its customers' eyes, its Net Promoter Score. Bain analysis shows that sustained value creators—companies that achieve long-term profitable growth—have Net Promoter Scores (NPS) two times higher than the average company. And Net Promoter System℠ leaders on average grow at more than twice the rate of competitors.

By focusing on your NPS, you are focusing on your customers. By focusing on your customers, you are focusing on your revenue.

This enables you to build a company where your customers sell for you. Your business needs to be able to rely on your customers to generate referrals which you can then turn into new customers. Your NPS survey allows you to measure how effectively your customers are doing that, and which markets and areas of the business you can focus on to generate more promoters.

Net Promoter System℠ is based on the fundamental perspective that every company's customers can be divided into three categories. “Promoters” are loyal enthusiasts who keep buying from a company and urge their friends to do the same. “Passives” are satisfied but unenthusiastic customers who can be easily wooed by the competition. And “detractors” are unhappy customers trapped in a bad relationship. Customers can be categorized based on their answer to the ultimate question. Any 9s or 10s are considered Promoters.

Any 7s or 8s are considered Passive respondents. And any score from 6 to 0 is considered a Detractor. If we ask each respondent “How likely are you to recommend [OUR COMPANY] to a friend or colleague?” The best research questions are about past behavior, not future behavior. Asking a study participant “Will you try to live a healthy lifestyle? Or Are you going to give up sugar? Or Will you purchase this product?” Requires they predict their future behavior. We are more interested in what they’ve done than what they’ll do. We’re interested in actual behavior, not a prediction of behavior. To understand how the net promoter score, NPS is easy to game visit this blog post.

Key performance indicators, KPIs, are central to product superiority, or operationally excellent strategy. For most companies, fine-tuning the metrics of operating their business and reviewing their progress is as essential as growing their business. Also, shareholders demand growth, they insist on more. More profits, market share, dividends than what was delivered previously.

Where does growth come from? In a world characterized by performance superiority or operational excellence, what are the sources of significant growth that a company can enjoy? Two different types of sources exist that appear fairly distinct from each other, but in actuality, they are just alternative flavors of the same kind of growth. One source of growth involves taking established products and services and introducing them to new customers. One of the purposes of marketing is to attract attention and create interest in new customers.

Innovation is another source of growth. Innovative products offers the innovator a competitive advantage that provides an opportunity to achieve higher profit margins. Innovative profit models find a fresh way to convert a firm’s offerings and other sources of value into cash. Great ones reflect a deep understanding of what customers and users actually cherish and where new revenue or pricing opportunities might lie. In addition to producing and distributing a particular set of products or services, innovative companies ask what else can be done? H. J. Heinz Company provides a good example.

An obvious source of growth consists of new products or extensions to existing products. “Product performance innovations address the value, features, and quality of a company’s offering. This type of innovation involves both entirely new products as well as updates and line extensions that add substantial value. Products and services connect or bundle together to create a robust and scalable system. This is fostered through interoperability, modularity, integration, and other ways of creating valuable connections between otherwise distinct and disparate offerings.”

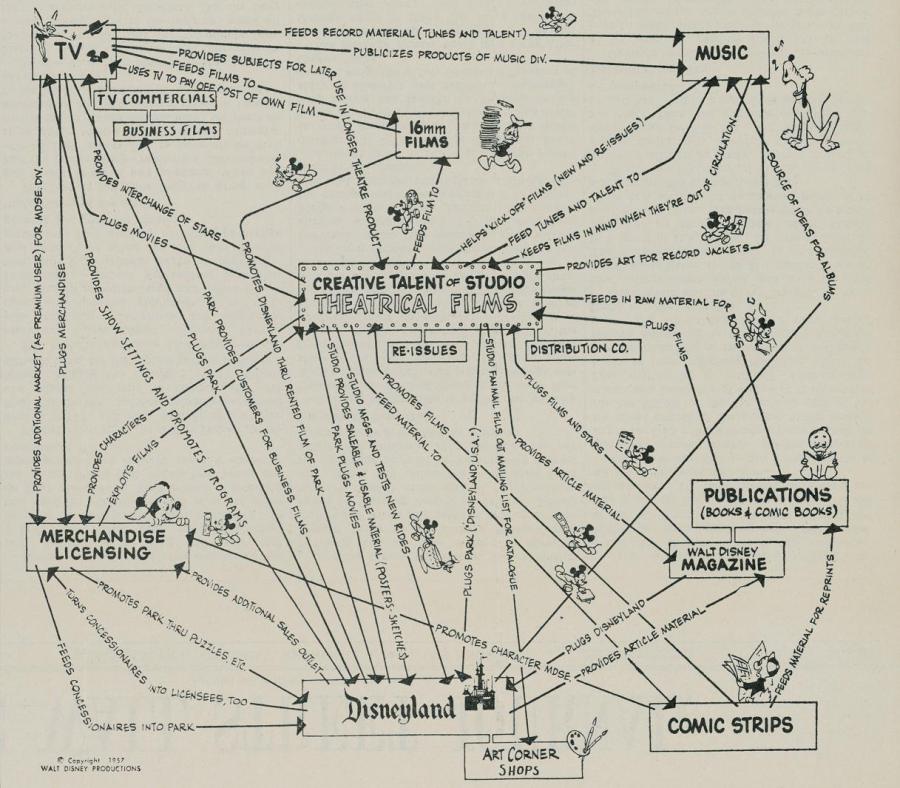

Product System innovations are rooted in how individual products and services connect or bundle together to create a robust and scalable system. Product System innovations help you build ecosystems that captivate and delight customers and defend against competitors. For example, review the Walt Disney strategy for growth using film assets to infuse value into other companies assets. Some of these idea concepts are presented at the Doblin “Ten Types” Website.

Image from this Debasish Kaushik Blog

Image from this Debasish Kaushik Blog

This 1957 map of Walt Disney’s vision defined his company’s key assets, including a valuable and unique core, and identified patterns of complementarity among them. It implicitly revealed the industry’s future evolution and provided guidance concerning adjacent competitive terrain that Disney might explore. The asset and capability combinations that emerged from the theory have evolved with time, but the theory itself has not fundamentally changed. The fundamental patterns and the underlying insight and intuition of the firm are still entirely consistent. The strategic vision that Walt long ago composed has revealed a succession of strategic possibilities that have fueled a remarkable record of value-creating growth.

This strategy has recently once again delivered impressive results. 'Star Wars: The Force Awakens' is the all-time domestic box office king. “The marketing campaign Lucasfilm put together is arguably one of the finest in recent memory. The studio went all out to raise awareness for the saga’s latest installment, and the months leading up to the movie’s release was a full blitzkrieg of television spots, trailers, and of course, copious amounts of licensed merchandise – ranging from Hasbro toys to Kraft macaroni and cheese.” reference ScreenRant.

In the summer of 2019, Disney will open a Star Wars-themed land at Disneyland along with a Star Wars themed luxury Hotel.

The concept of bringing the current product to new customers and the concept of developing new and different products come across as reasonably distinct sources for growth. Moreover, the tactics associated with each of them, as well as their corporate expertise, uphold their differences. When viewed strategically, both of them actually have a lot in common.

Both tactics share this basic idea: Companies have a certain degree of product expertise, how can they extend it to new customers or extend it to new products? Despite how companies choose to grow their business, consider that the primary source of growth involves extending the overall product or service delivery. Those companies that excel at doing a certain expertise do so as efficiently or effectively as possible. How can they take that product expertise and extend it in new directions? What is required to run the existing business as well as determine how to extend the existing product? Apple has become one of the worlds most profitable companies by using the tactic of extending their products expertise. For a graphic display of that expertise view this Wikipedia chart: Apple Products

Amazon's distribution business requires huge investments in computer servers. Amazon Web Services (AWS) is a secure cloud services platform, offering computing power, database storage, content delivery, and other functionality to help businesses scale and grow by using Amazon's existing investment in computer hardware.

The organizational chart of almost any company is the common theme that the company is centered around the various products and services that it delivers. A product manager or a brand manager exists, but it's all about having separate silos around the different products or services and organizing all the activities in like manner. Each different silo is responsible for running its own operation as efficiently as possible in addition to creating new methods of extending that kind of product expertise. The idea of product or service expertise is the driving force of how most companies operate. It also serves as the competitive advantage that managers, industry experts, and academics have focused on for many years. We are the best at conceptualizing, developing, and delivering a certain kind of product or service. We are going to stay ahead of our competitors by becoming more efficient.

Danny Meyer’s Union Square Hospitality Group (USHG), which owns fine dining restaurants like Union Square Café and Gramercy Tavern, famously operated the first iteration of Shake Shack in New York City’s Madison Square Park as a summer hot dog cart from 2001 to 2003. After USHG opened the first permanent Shake Shack as a kiosk in the park in 2004, Meyer’s team spent years refining the craft. They focused on serving better-quality burgers, hot dogs, shakes, and fries; treating guests with a level of hospitality more often found in restaurants than fast-food joints; and making its cultish following of customers happy enough to endure those infamously long lines. USHG has successfully transferred its expertise in “treating guests” to a new set of customers.

“We realized that the causal mechanism behind a purchase is, 'Oh, I've got a job to be done.' And it turns out that it's really effective in allowing a company to build products that people want to buy. Looking at the market from the function of a product really originates from your competitors or your own employees deciding what you need. Whereas the jobs-to-be-done point of view causes you to crawl into the skin of your customer and go with her as she goes about her day, always asking the question as she does something: Why did she do it that way?” Clayton M. Christensen.

So, if jobs-to-be-done market segmentation is so effective, why aren't more companies designing their products accordingly? For one thing, future product planning usually involves analyzing existing data, and most existing data is organized by customer demographics or product category. A good use of the “jobs-to-be-done” strategy is evaluating opportunities for new uses for current products.

A Chrysler Executive observed customers having difficulty loading lumber into their Minivan. The “jobs-to-be-done” solution was to fold the rear seats into the floor. This feature was a big hit and spurred additional Minivan sales.

“Design thinkers explore process improvements and improvise solutions. They work to incorporate those ideas into the offerings they create. They also consider what we call the edges, the places where 'extreme' people live differently, think differently, and consume differently. Time and again, initiatives have faltered because they are not based on the client’s or customer’s needs and have never been prototyped to solicit feedback. Often when people enter the field, they do so with preconceived notions of what the needs and solutions are. Unfortunately, this flawed approach remains the norm in both the business and social sectors.” reference: Design Thinking for Social Innovation By Tim Brown & Jocelyn Wyatt. Stanford Social Innovation Review Winter 2010

“The secret of Appleʼs success is about design and a different way of thinking. Design at its essence, is not just about form, and not just about function. Instead, itʼs both, and more. It is ultimately about the user and delivering exactly what they need, not just what they say they want. Apple takes it as their responsibility — what customers pay them for — to both know technology and customers better than customers know themselves and deliver products that truly surprise and delight. And it is surprise and delight that builds a powerful and long-lasting brand that goes from success to success without any dilemma at all.”

“Moreover, it is a way of thinking that Apple does not have a monopoly over. It requires acknowledging that there are product attributes that cannot be measured, and that value means much more than money. It also requires thoughtfulness and patience, and a broad appreciation of people and culture. Escaping the Innovatorʼs Dilemma, is about escaping the operational mindset that is the current ideal in much of business. In short, there are few other companies like Apple because no one dares or is allowed to think different, not because it is impossible.”

Ben Thompson writing on his Blog “Stratechery” in a 2013 article titled; Apple the Black Swan

“Disruptive technologies bring to a market a very different value proposition than had been available previously. Generally, disruptive technologies underperform established products in mainstream markets. But they have other features that a few fringe (and generally new) customers value. Products based on disruptive technologies are typically cheaper, simpler, smaller, and, frequently, more convenient to use.” Clay M. Christensen. Read more on the importance of disruption.