Current strategies in pricing

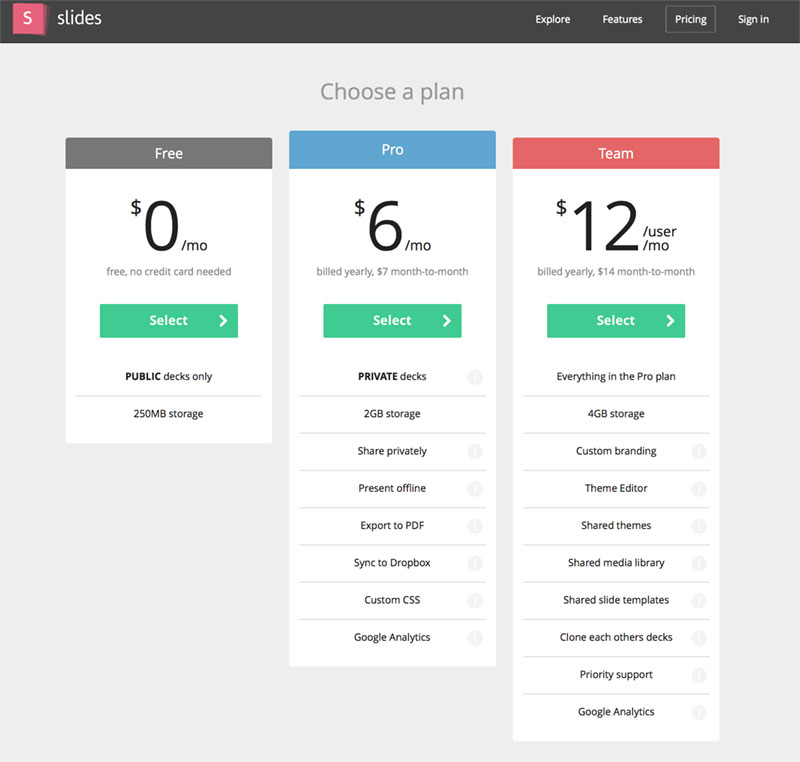

From Slideshare — An example of a company leveraging sunk cost and zero or close to zero distribution cost. A zero price option is a strategic use of price to build the business. You need to be very aware of what the economists refer to as “Opportunity cost” — the loss of potential gain from other alternatives when “free” is an option. The free service has to be monitored for its use of time and space

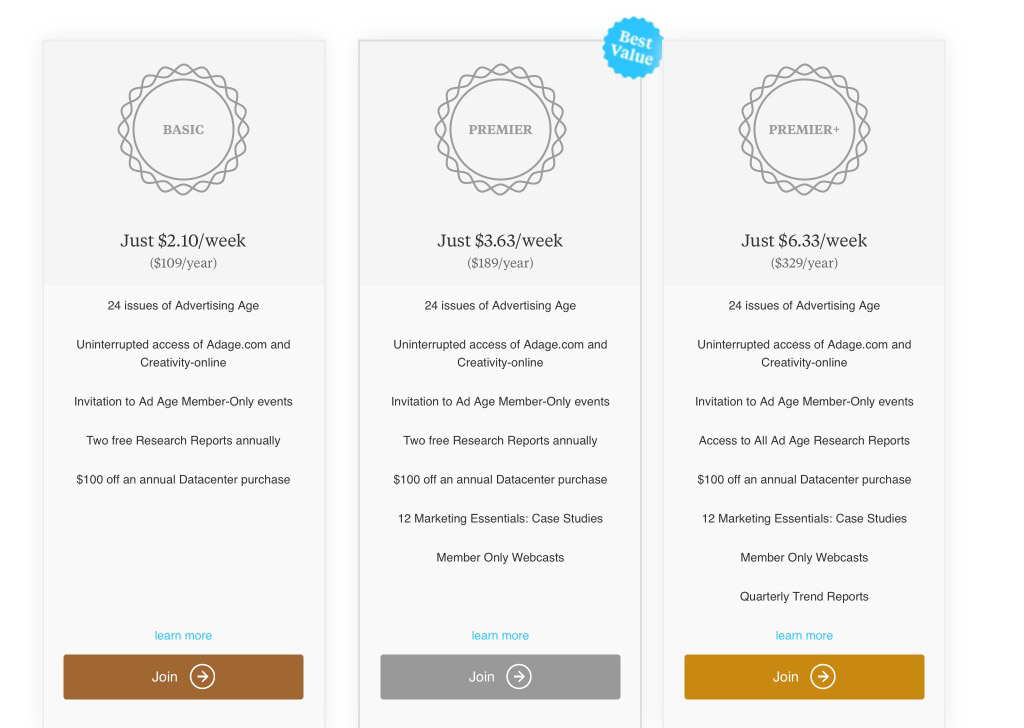

Price for subscription to AdAge with a “Best Value recommendation.”

Price for subscription to AdAge with a “Best Value recommendation.”

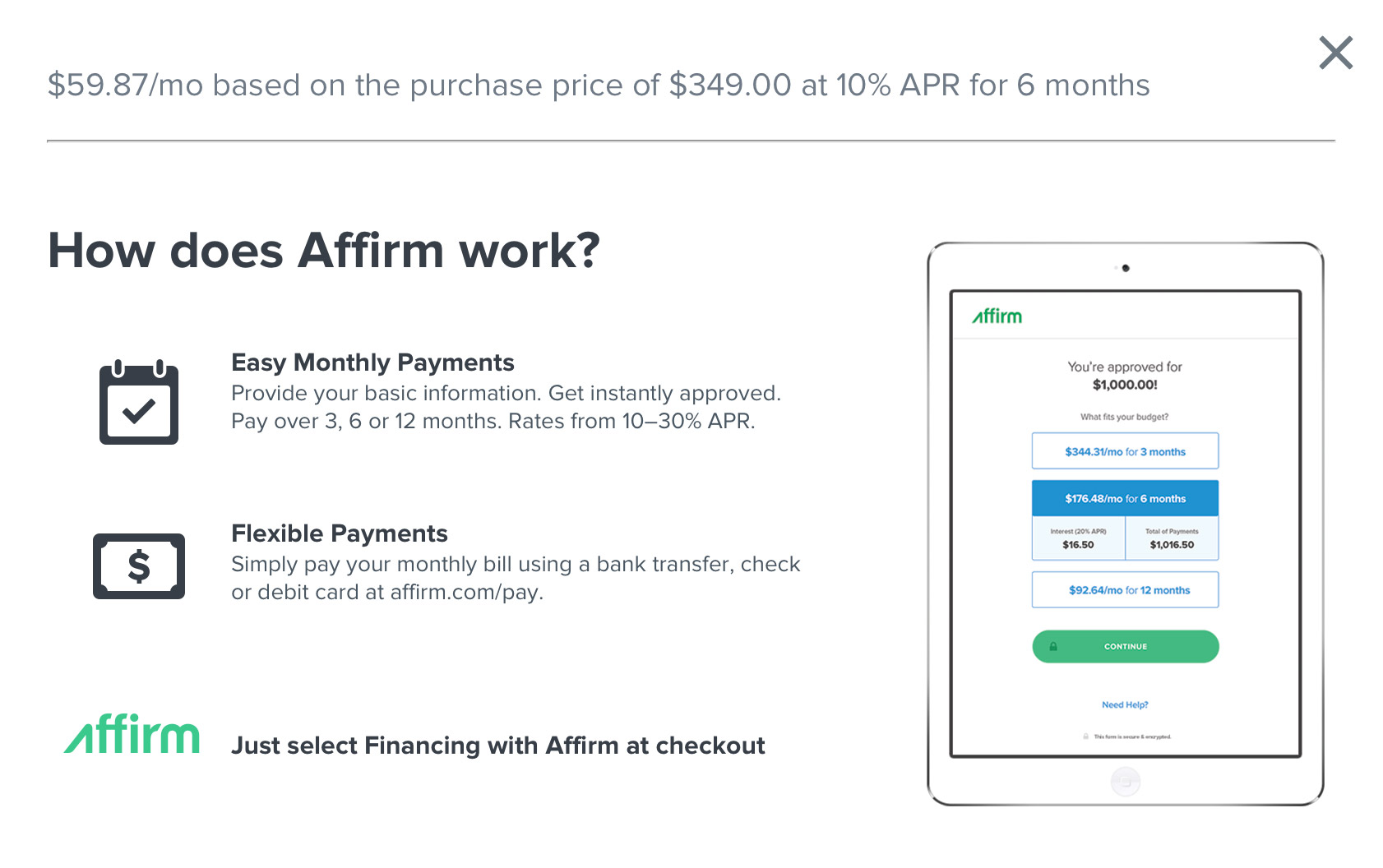

A easy credit plan from Pure Fix Cycles.

A easy credit plan from Pure Fix Cycles.

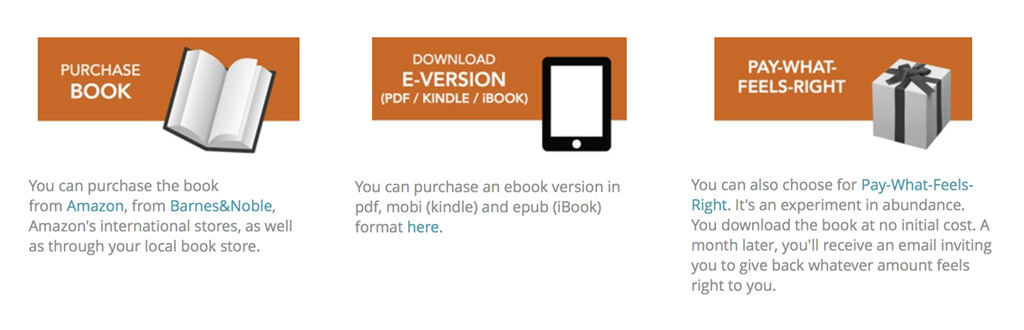

“Giving buyers the freedom to pay what they want can be very successful in some situations because it eliminates many disadvantages of conventional pricing. Buyers are attracted by permission to pay whatever they want, for reasons that include eliminating the fear of whether a product is worth a given set price and the related risk of disappointment (‘buyer's remorse’). For sellers, it obviates the challenging and sometimes costly task of setting the ‘right’ price (which may vary for different market segments). For both, it changes an adversarial conflict into a friendly exchange, and addresses the fact that value perceptions and price sensitivities can vary widely among buyers.” From: Smart Pricing, Chapter 1. "Pay As You Wish" Pricing, Raju and Zhang, Wharton School Publishing, 2010. ISBN 0-13-149418-X.

“Giving buyers the freedom to pay what they want can be very successful in some situations because it eliminates many disadvantages of conventional pricing. Buyers are attracted by permission to pay whatever they want, for reasons that include eliminating the fear of whether a product is worth a given set price and the related risk of disappointment (‘buyer's remorse’). For sellers, it obviates the challenging and sometimes costly task of setting the ‘right’ price (which may vary for different market segments). For both, it changes an adversarial conflict into a friendly exchange, and addresses the fact that value perceptions and price sensitivities can vary widely among buyers.” From: Smart Pricing, Chapter 1. "Pay As You Wish" Pricing, Raju and Zhang, Wharton School Publishing, 2010. ISBN 0-13-149418-X.

Further reasons for sellers implementing PWYW-pay as you wish pricing includes price discrimination and market penetration. Price discrimination occurs as a result of buyers with higher valuations of the product choosing to pay a higher price. Thus, price discrimination could result in higher revenues for the seller if costs are sufficiently low. PWYW is also an effective tool for penetrating a new market, perhaps to introduce a new brand, as even consumers with a very low valuation can pay small amounts for the same product. Reference: http://epub.ub.uni-muenchen.de/14312/

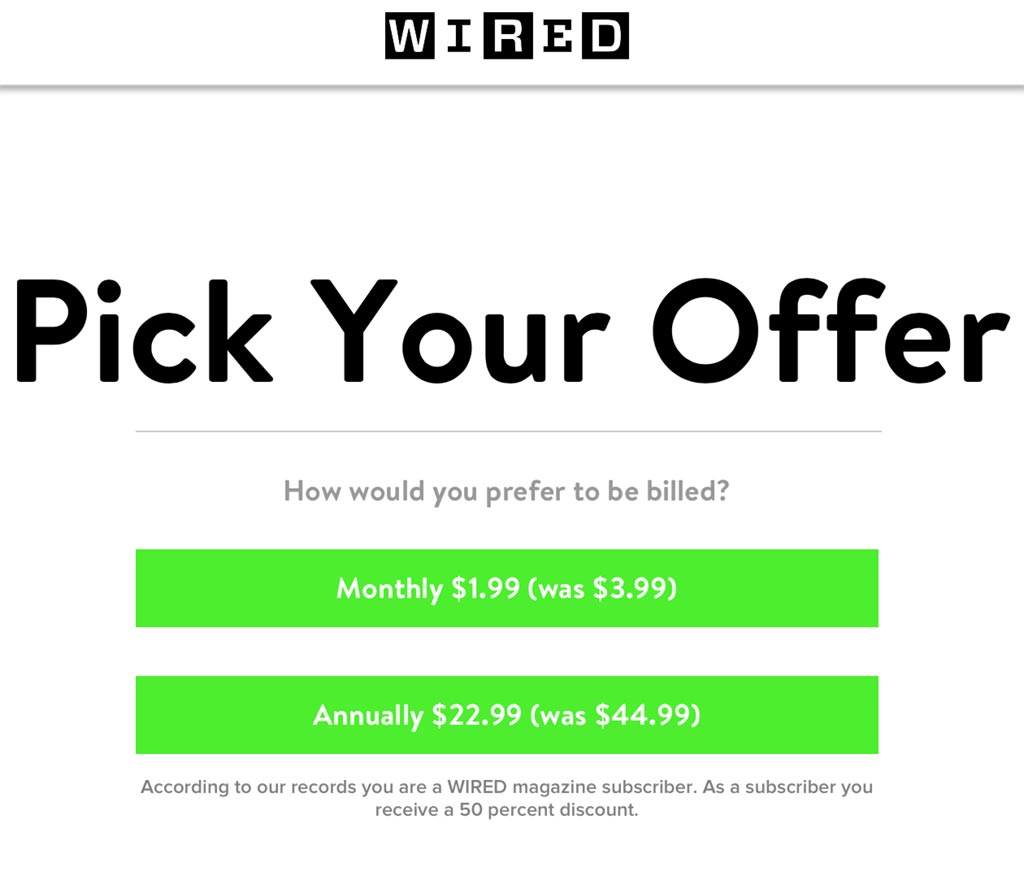

Notice how Wired Magazine steers the potential subscriber to pay $22.99 for an annual subscription that is better than the former $44.99 price, that I never purchased, and slightly better than the sum of 12 monthly payments of $1.99 that is much lower than the previous price of $3.99 which I also never purchased.

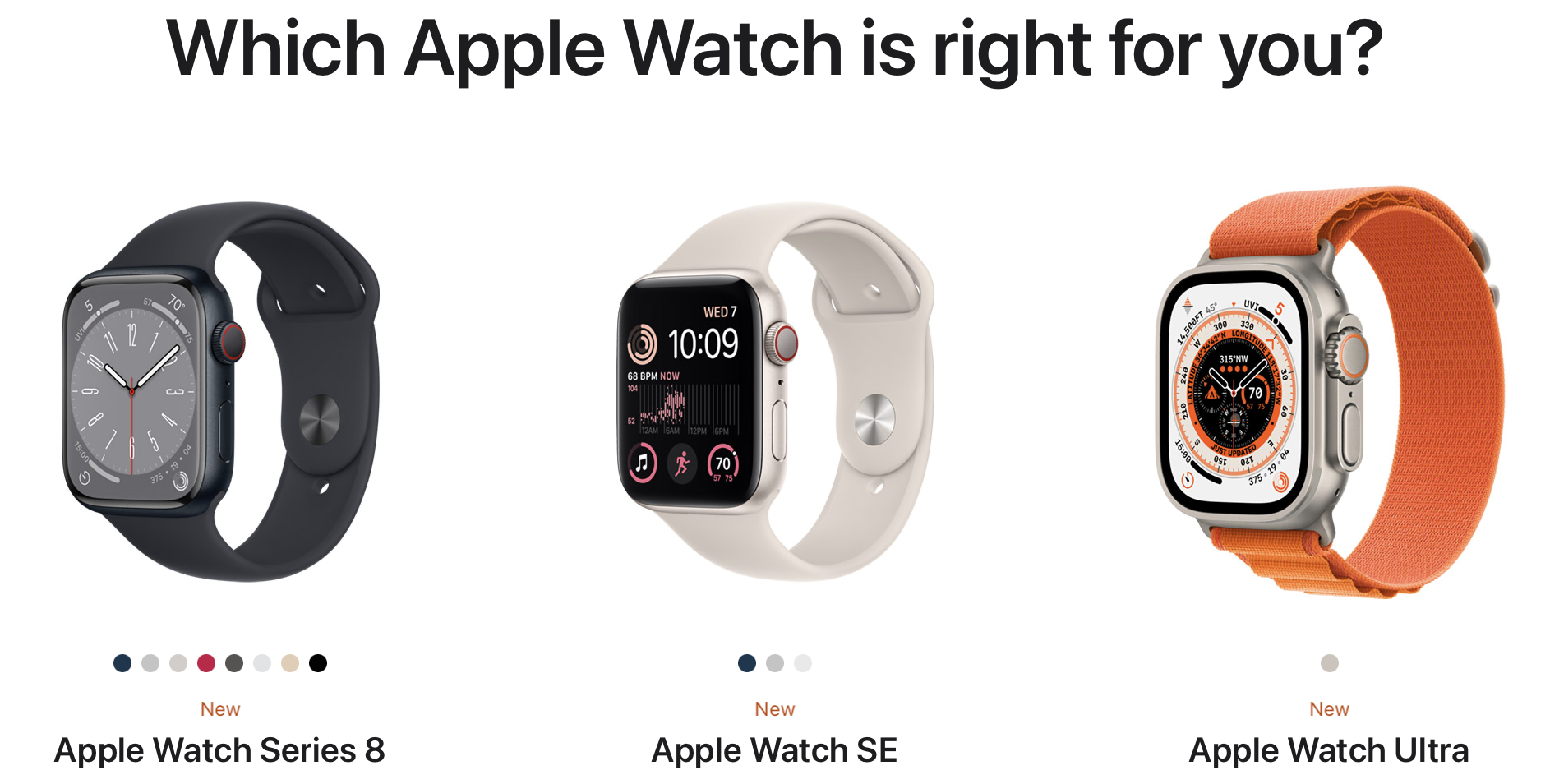

Prior to the availability of the Apple Watch for purchase, there was a lot of discussion on Apple's pricing strategy. Rafi Mohammed, a pricing expert and the author of “ The 1% Windfall – How Successful Companies Use Price to Profit and Grow ” commented on the HBR Blog “the top-of-the-line $17,000 version — why spend even $3,000 today for an everyday wearable that will look outdated and be functionally inferior in a year or so? It doesn’t make sense. In contrast to the advertising tagline for Patek Phillipe (‘ You never really own a Patek Phillipe, you merely look after it for the next generation ’), consumers who buy a Watch are choosing a very expensive disposable timepiece.”

He also comments on the price range “the price range is extremely wide — in fact, it’s too wide, and that’s a big mistake. It’s rare for one brand to serve such a wide spectrum of customers — in the Watch’s case, $349 (somewhat accessible) to $17,000 (garishly expensive). Timex, for instance, targets the lower price range in the watch market while Rolex serves the high end.

The gold version was known as the Apple Watch Edition, a name that now applies to a new ceramic version of the product that was briefly mentioned on stage and starts at $1,249. The top-of-the-line $17,000 version was quietly dropped September 2016. Reported by Quartz

The downside of this wide price range, from a brand perspective, is further complicated by the technology component of the Watch. When consumers see prices ranging up to $17,000, they tend to psychologically believe they’ll have to spend somewhere around the midpoint (say, $8,000) to get a “good one” (from a technology standpoint). The reality is the Watch’s technical performance is the same no matter what the price — the price differential is based on the various metals and adornments — but the wide price range obfuscates this truth.” Even if the company doesn’t plan to sell millions of its Edition watches, the product’s very existence reinforces the anchoring effect, making the $349 Sport watches seem downright reasonable.

Another example of framing effects in action comes from Dan Ariely’s book Predictably Irrational. In the 1990s, the company Williams-Sonoma introduced a bread maker in their stores for the first time, pricing it at $275. After lackluster sales, the store worked with consultants who recommended introducing a bigger and better model priced at $429. As a result, sales took off — not of the premium model, but the original $275 model. Why? With one product choice, customers with no frame of reference had trouble deciding if the bread machine was worth the money. But when compared against a much-more-expensive option, the original machine seemed cheaper and more appealing. This effect, called anchoring, is a strategy used in many retail environments.

Memberships

A Costco annual Gold Star Membership is $55. Costco is dedicated to bringing their members the best possible prices on quality, brand-name merchandise. With hundreds of locations worldwide, Costco provides a wide selection of merchandise, plus the convenience of specialty departments and exclusive member services, all designed to make your shopping experience a pleasurable one. Costco's operating philosophy is simple: Keep costs down and pass the savings on to their members. Their large membership base and tremendous buying power, combined with a never-ending quest for efficiency, results in the lowest possible prices for their members.

Amazon Prime is a membership program that gives customers access to streaming video, music, e-books, free shipping and a variety of other Amazon-specific services and deals. Amazon Prime is a no-brainer for those heavily invested in the Amazon ecosystem. The most convincing case for why Amazon pushes so aggressively on Prime is that members just spend a lot more. Analysts have found Prime customers spend somewhere in the realm of three times as much on Amazon every year as their non-Prime counterparts. Even factoring in the extra costs, this spending makes Prime members much more valuable to Amazon’s bottom line. Cost for membership; $119 a year.

For more pricing examples visit this HelpScout site and Pricing Experiments You Might Not Know, But Can Learn From